Renters Insurance in and around San Diego

Looking for renters insurance in San Diego?

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Calling All San Diego Renters!

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented apartment or condo, renters insurance can be a good idea to protect your personal items, including your stereo, desk, silverware, running shoes, and more.

Looking for renters insurance in San Diego?

Rent wisely with insurance from State Farm

Open The Door To Renters Insurance With State Farm

Renting a home is the right decision for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance may cover damage to the structure of your rented home, but that doesn't cover the repair or replacement of your belongings. Renters insurance helps protect your personal possessions in case of the unexpected.

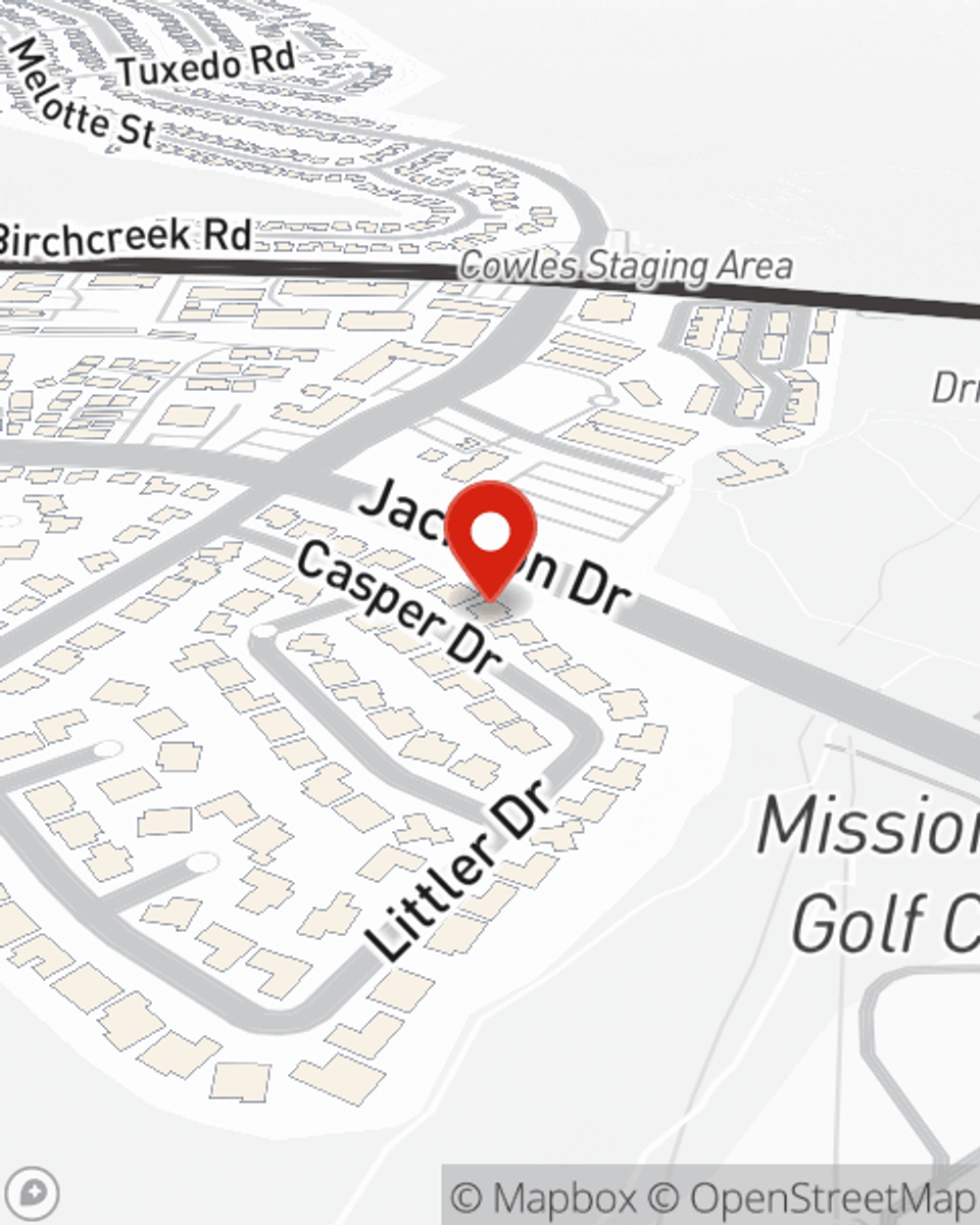

More renters choose State Farm® for their renters insurance over any other insurer. San Diego renters, are you ready to discuss your coverage options? Get in touch with State Farm Agent Fred Shadlow today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Fred at (619) 464-4261 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Fred Shadlow

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.